For both resident and non-resident companies corporate income tax CIT is imposed on income. Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment.

Individual Income Tax In Malaysia For Expatriates

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900.

. Not only are the. Corporate - Taxes on corporate income. Malaysia - Corporate income tax.

Except for gains derived from the disposal of real property or on the sale of shares in a real property company. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Income tax rates. Audit tax accountancy in johor bahru comparing tax. Corporate tax rates for companies resident in Malaysia is 24.

This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019. Free Online Malaysia Corporate Income Tax Calculator For Ya 2020. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of.

The rate is 30 for such disposals of. Company Tax Rate 2018 Malaysia Table. Tax Rate of Company.

Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85. Year Assessment 2017 - 2018. New principal hub companies will enjoy a reduced corporate tax rate.

Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income. On the First 5000. Rate TaxRM A.

Last reviewed - 13 June 2022. Headquarters of Inland Revenue Board Of Malaysia. Malaysia was ranked 12 out of 190 countries for ease of.

Masuzi December 15 2018 Uncategorized Leave a comment 1 Views. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. Tax Rate of Company.

Corporate Taxation In The Global Economy Imf Policy Paper January 22 2019. Income Tax Rate Malaysia 2018 vs 2017. As the clock ticks for personal income tax.

Rates of tax 1. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Morocco Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

How To Calculate Income Tax In Excel

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Doing Business In The United States Federal Tax Issues Pwc

Effective Tax Rate Formula Calculator Excel Template

China Annual One Off Bonus What Is The Income Tax Policy Change

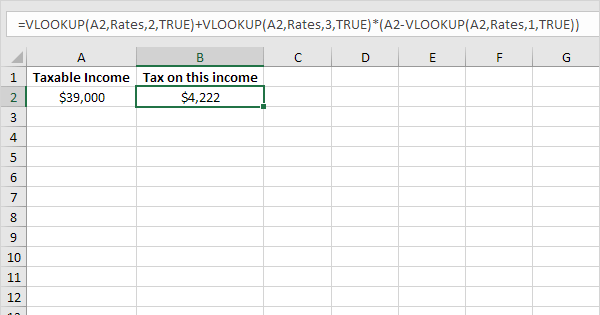

Tax Rates In Excel Easy Formulas

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Corporation Tax Europe 2021 Statista

Income Tax Formula Excel University

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)